Higher oil prices, state investment and Central Bank interventions have maintained a relative stability in the Russian economy in 2017, but it is difficult to see which incentives could keep the Russian economy flowing this year. According to economist Vladislav Inozemtsev in an article for Intersection, economic reforms will not come from political change. Rather it will be the other way around: the need to make shifts in the economy will possibly push political reforms in 2018.

Many feared what 2017 might bring, partly for rational reasons, partly for superstitious ones. The centenary of the Russian Revolution alone was enough to give 2017 a certain chilling mystique.

Those who made such bearish predictions must concede that 2017 has ended with no serious upheavals. That is, if we disregard the imprisonment of an unlucky minister and the evisceration of an oligarch who has long ago fallen out of favor. Otherwise, the year was surprisingly stable from an economic perspective – there was almost no economic growth (if the December decline rate is the same as that in November, the annual result may reach 1.4%); disposable income also remained virtually unchanged (-1.3% in January-October); inflation slowed to 2.5% - a record low in contemporary Russian history; not to mention the dollar and the stock market, which ended the year where they started (the ruble appreciated by 3.2% and the RTS index dropped by 4.1%).

However, significant shifts are hidden below the surface stability. Commentators have not paid enough attention to them – neither during the year nor when summing it up. The virtually unchanged economic situation formed by several powerful forces results from large inward and outward flows, whose importance should not be underestimated.

Oil prices

To begin with, one cannot disregard what lies at the heart of it: oil. The price drifted up throughout the year, driven by the extremely optimistic expectations of businesses in the U.S. and Europe, and the skillful maneuvering of Russia and its fellow OPEC members, who managed to struck a deal to limit production in order to push up global oil prices. One can only applaud the result, from a Russian perspective: annual growth of oil prices by almost 20% (from $54.10 to $64.50 a barrel).

To make this figure less abstract, let us underline that Russia exported nearly 260 million tons of oil and nearly 155 million tons of petroleum products during the year. In other words, Russian exports grew by at least $23.5 billion (equivalent to nearly 10% of budget revenues). Even if the price growth stops in 2018, this money will long be spreading through the economy, seeping into its most secluded spots, bringing life back to desolate corners. Oil (not to mention gas and other commodities whose prices have also risen during the year) happened to be the first injection applied to the sick Russian economy throughout the year.

Public spending

Another treatment was public spending, which was high compared to past periods. In 2016, the federal budget spent the largest amount in history on defense: 3.82 trillion rubles ($ 67,5 billion). At least one-fifth of this amount went through the treasury at the very end of last year, and was therefore 'digested' by the economy in 2017. Also in late 2016, a crafty transaction worth 692 billion rubles ($ 2 billion) was made, which concealed the privatization of 19.6% of Rosneft’s shares – this money was also injected this year.

Large state-owned companies significantly increased their investment programs (by almost 400 billion rubles; $ 7 billion) despite their failure to pay expected dividends to the government. Finally, 2017 has become the most impressive year since 2013 in terms of the scale of budgetary spending on infrastructure: this year marked the peak of work on the Kerch Strait Bridge [connecting Crimea to Russia], and construction of the main facilities for the World Cup. Undoubtedly, all of this is being done at the cost of significant depletion of reserve funds, while the extent of the problems is manifested by an extension of a freeze on cost-of-living adjustments for pensions not for a year but for two years now.

Cleaning up the banking system

The third substantive injection was applied by the Central Bank of Russia, whose efforts to clean up the banking system have finally born fruit. Nabiullina’s team has outdone itself: the stars of Yugra, Otkritie, B&N Bank and Promsvyazbank, not to mention a whole constellation of smaller banks, have disappeared from the banking skyline within a year. However, a considerable surplus of liquidity emerged in the market: As of late August, the Central Bank of Russia injected more than 1 trillion rubles (17,7 billion US$) into Otkritie alone. Translating this into comprehensible language, this money has simply been printed.

Head of the Central Bank Elvira Nabiullina cleaned up the private bank sector. Photo free of copyright

Head of the Central Bank Elvira Nabiullina cleaned up the private bank sector. Photo free of copyright

The Central Bank of Russia has been printing money over the course of the year, first for the sake of the Deposit Insurance Agency, and then for the Banking Sector Consolidation Fund. The sum of this expansion has clearly exceeded 1.5 trillion rubles ($ 26,5 billion) this year. Taking into account that a significant proportion of the shortage of resources 'unexpectedly' faced by the above-mentioned banks was previously invested in low-liquidity projects from their owners and digested by the economy, when we analyze the results of the year, the Central Bank of Russia can be considered an agent of maintaining economic growth on a par with global oil traders, the federal budget and state-owned companies.

Thus, during 2017 the Russian economy has demonstrated unprecedented growth of about 1.5%. If I am not mistaken, this result can hardly be called impressive. But everything in the world has its explanation.

Capital outflow

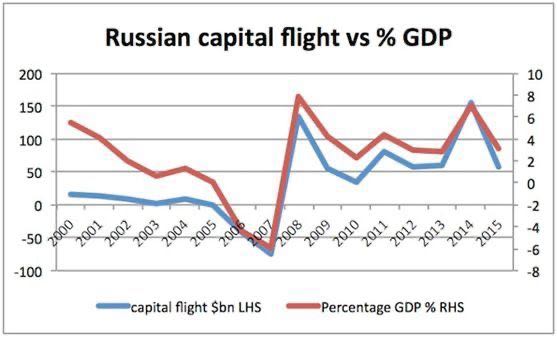

Let us consider Lake Baikal, rightly considered one of the symbols of Russia. The lake is fed by 336 rivers of various sizes. It is drained through a single outlet, the Angara River. Something similar is happening in the country. Of course, I am thinking of just one of Russia’s major ills: capital outflows. Just a few days ago, the Central Bank drastically raised its forecasts of outflows from $17 billion to $29 billion (i.e. almost 2 trillion rubles). What is more, capital outflows in the corporate sector reached $14 billion in the third quarter alone. Obviously, when we compare these figures with the 2014 indicators, they seem negligible. Still, I would suggest other comparisons.

The economy often experiences sharp movements which are quite difficult to predict. Therefore, it is better to consider trends over longer time periods. If we compare the 2000s with the 2010s, a rather unpleasant picture emerges. Net capital outflows from Russia reached $120.1 billion in the 10 years from 2001 to 2010. At the same time, a massive positive balance of the capital account was observed in 2007 and 2008. This means an average of $12 billion left Russia each year.

If we compare this with the situation in the 2010s (when capital inflows cannot even be dreamt of), it will turn out that even the most prosperous year in this respect, 2016, with its $15.4 billion, significantly exceeds the average figure for the preceding decade. Cold hard statistical facts of the Central Bank indicate that $450.2 billion has left the country during the last seven years, or $64.3 billion a year, more than five times the amount in the 2000s. Similar to the country’s leaders, we can be tempted to calculate everything in rubles (the exchange rate dropped significantly during the period under consideration) and we will then have to admit that, on average, 11 times more money has flown out of the country since 2011 compared to the annual outflow during the most prosperous decade i.e. the 2000s.

In other words, powerful undercurrents could be observed in 2017 under the relatively calm surface of the lake of the Russian economy. These undercurrents brought about a slight rise in the water level, which cannot be considered irreversible. The Central Bank of Russia stresses that capital outflows in recent years are primarily due to Russian companies’ and banks’ repayment of borrowing abroad. The outstanding balance amounted to $486 billion as of October 1, and refinancing cannot be expected under the present circumstances.

Incentives in 2018

Assuming that oil prices have reached the ceiling set by the profitability of shale extraction; that reserve funds are largely depleted; that no investment programs are planned; that practically all private banks 'have been cleaned up' – it is difficult to identify flows that could feed the Russian economy in 2018.

I will steer clear of predicting catastrophic events that may await Russia in the upcoming year, given that the authorities always have effective means of intervention such as devaluation up their sleeve, and that shocks are rare when inflation expectations are low.

Still, I want to emphasize that unlike Russian politics, which has no place for an opposition and where all decisions are made by a single person, the unprecedented economic stability is the result not of the cessation of all internal movement, but its activation.

And that is why it still seems to me that in the very near future, it will not be political changes to push economic reforms forward; rather, significant shifts in the economy will accelerate political reforms.

This article was republished with permission from

![]()