Russia’s dependence on revenues from oil and gas production is now higher than that of the Soviet Union in the 1980’s. The prospects for fossil fuels have deteriorated, however, in recent years. US shale oil gives a downward pressure on oil prices. The increased determination to combat climate change gives a downward pressure on oil demand. The challenge to maintain Russia’s oil production at its current high level is becoming greater. Energy specialists Jilles van den Beukel and Lucia van Geuns from HCSS explain how the Russian oil and gas industry, and the Putin regime, deal with these challenges and what are its prospects.

by Jilles van den Beukel and Lucia van Geuns

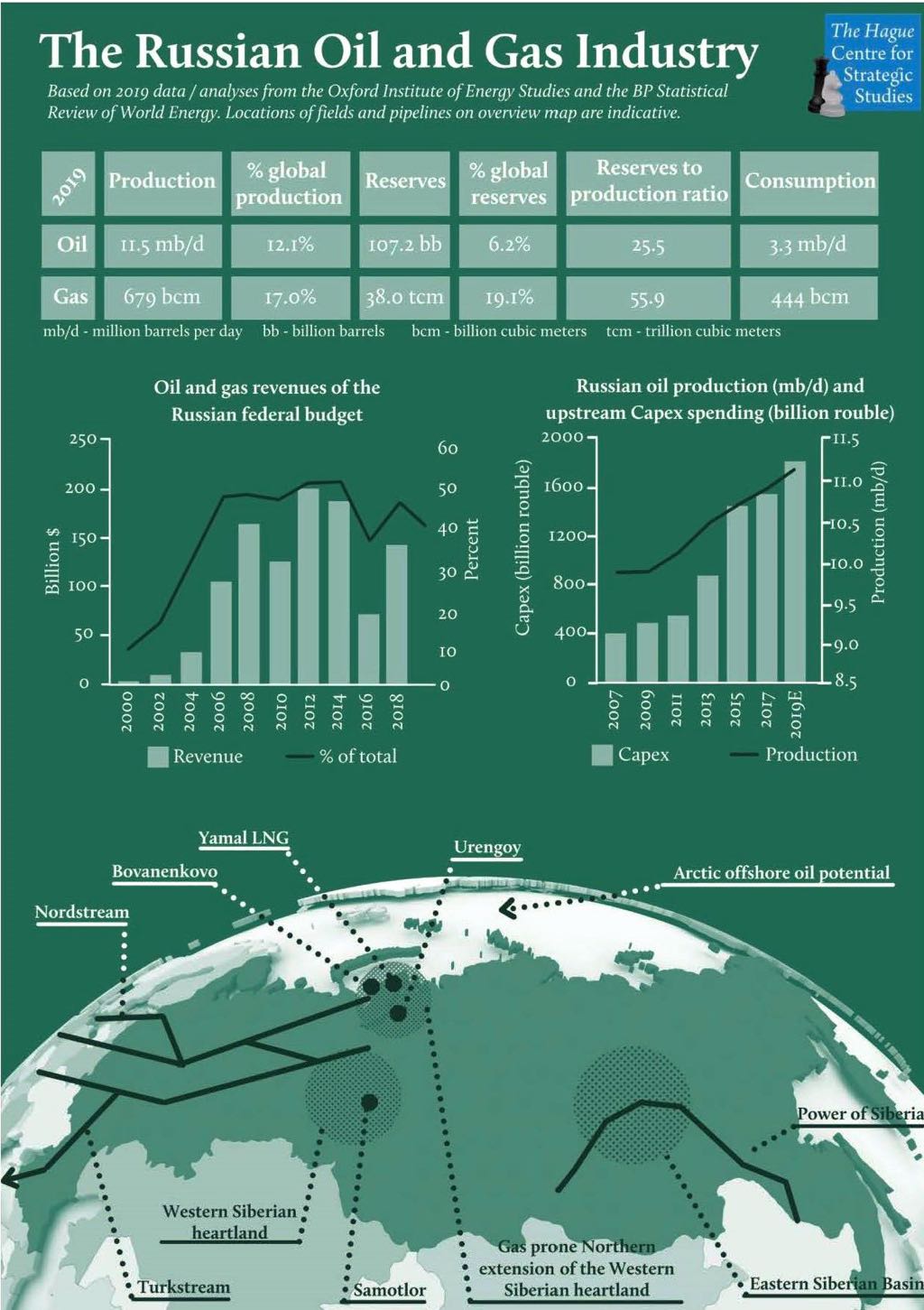

In 2019 Russia was the 11th-largest economy in the world, ranking in between Canada and South Korea. In terms of military capacity and fossil fuel production, it is a superpower, however. About 25% of the EU’s oil demand and close to 40% of its gas demand is met by Russia.

Revenues from oil and gas production are essential for Russia. Over the last decennium, they accounted for 40 to 50% of the Russian federal budget and about two thirds of Russian exports. In the western world the oil and gas industry is becoming less important; in Russia the opposite is happening.

Oil and gas play different roles in Russia. Oil and gas production are roughly similar in terms of energy produced (in both cases production exceeding 10 million barrels of oil equivalent per day). Most oil is exported and oil, per unit energy worth much more than gas, accounts for about 80% of the proceeds from the export of fossil fuels. Gas, on the other hand, is mostly consumed locally for a low, regulated, price. Gas accounts for about 55% of Russia’s primary energy consumption; one of the highest shares worldwide. It is gas that keeps the industry going and buildings warm. Whereas oil pays the bills, gas keeps an inefficient economy and society working.

Oil production becomes a challenge

Russia is, with Saudi Arabia and the US, one of the top three global oil producers. Russian oil reserves are only the 7th largest in the world, however, and maintaining production levels is becoming more challenging. Break even costs for new oil projects are expected to rise from $20 to $30 per barrel over the coming decade. These new projects require major tax exemptions. Exploration outside the West Siberian Basin, the heartland of Russia’s oil production, has seen limited success.

Sanctions are increasingly limiting the Russian oil industry’s ability to maintain production levels. The Russian oil industry lacks the technical expertise to profitably develop its world class Bazhenov shale oil reserves. Large parts of the Arctic resources lie offshore, and the Russian oil industry has virtually no offshore operating experience.

In Russia oil pays the bills and gas keeps an inefficient economy and society working

In contrast to Russia’s more limited oil reserves its natural gas reserves are the largest in the world. The challenge here is not to produce the gas but to export it and to make money from it in a gas world that has fundamentally changed. The rise of Liquid Natural Gas (LNG) shipping now enables the transport of low-cost gas from LNG market leader Qatar, shale gas from the US and many other countries to destinations across the world. Over the last decennium gas prices on the international markets in the US, Europe and Asia have had a tendency to converge and decrease.

Russia will remain the key supplier of gas for the EU but with the advance of LNG, abundant LNG import capacity within the EU and the liberalization of European gas markets Gazprom’s pricing power has diminished.

Symbiosis of energy industry and regime

There is a symbiotic relationship between the government and the Russian oil and gas industry. Oil and gas are the major source of income for the government. Oil and gas companies will not challenge the primacy of the Kremlin. Gazprom and Rosneft will undertake projects where the interests of the Russian government take preference over commercial considerations.

In return, the Russian state provides maximum support for the oil and gas industry. The devaluation of the rouble and numerous tax exemptions have made it possible for the Russian oil and gas industry to increase investments in the post 2014 low oil price world and to continue to grow production. A progressive tax regime protects Russian oil companies from low oil prices.

This symbiosis with the Russian oil and gas industry not only applies to the Russian government but also to Putin’s entourage. Oil trading, rigged auctions of oil and gas assets and the construction of major projects such as pipelines, at elevated prices, provide ample opportunities for the enrichment of the circle around Putin, which controls many of the oil and gas service companies.

A murky and opaque world

The primacy of the Kremlin does not mean that there is a strict, detailed, all-encompassing plan for the Russian oil and gas industry. There is a lot of counterproductive rivalry between different actors and companies. Rosneft and Gazprom were engaged in a fierce power struggle during the early Putin years and have never cooperated on their Sakhalin projects.

Rosneft and Gazprom also need to serve the Kremlin’s ambitions and geopolitical interests. Whilst doing so they are, in contrast to their domestic competitors, taking on large debts. Smaller companies like Surgutneftegaz and Novatek tend to have a better technical track record than Gazprom and Rosneft. What is lacking in Russia are small niche companies. That licenses cannot be transferred, but have to be given back to the state, effectively precludes the emergence of small niche operators in exploration or end of field life production. Such niche companies are often highly efficient operators in the western world.

Graphic HCSS

All Russian oil and gas companies aim to have a good standing with Vladimir Putin. For outsiders, this is a murky and opaque world. The ability to secure tax exemptions has a large influence on profitability. Good contacts are more important than good contracts. Vladimir Yevtushenkov’s Sistema holding was forced to give up its majority share of Bashneft to the state; a share that subsequently ended up with Rosneft.

Novatek: the new kid on the block

Gazprom losing its monopoly on LNG exports (whilst retaining it for pipeline exports), after years of dragging its feet on LNG, opened up the door for its competitors. It is Novatek that has taken, or has been given, the lead on LNG. Under the leadership of Leonard Mikhelson, Novatek had become Russia’s largest independent gas producer. It also has a highly profitable focus on the production of condensates - a liquid by-product from gas fields. Novatek’s other major shareholder, Gennady Timchenko, provides the political protection.

The government provides ample opportunities for the enrichment of the circle around Putin, controlling the energy market

With the help of western technology (Total) and Chinese funding (CNPC), Novatek has delivered its Yamal LNG plant on time and within budget. Novatek has been allowed to order LNG carriers from low-cost suppliers in South Korea rather than from Russian suppliers. It has ambitious plans to further expand LNG capacity. Novatek’s LNG projects are a financially more attractive way of finding new customers for Russian gas than Gazprom’s expensive Power of Siberia pipeline project. Novatek is shaking up the Russian gas industry, not unlike Yukos once did for the oil industry, but it is doing so as a system insider rather than as a system outsider.

Unsustainable business model

Many countries are now beginning to decarbonise their energy system, in order to address climate change. Reduced demand for fossil fuels will, in the long run, exert a downward pressure on oil and gas prices. A shift towards low-cost oil is expected. Here, higher cost Russian oil fields will be at a disadvantage against oil from low-cost Middle East producers like Saudi Arabia. Russia’s recently published energy strategy to 2035 focuses solely on maintaining oil production levels and increasing gas exports. It chooses to ignore the forthcoming energy transition.

From an economic point of view Putin’s position has weakened. Over the last decade Russia’s share of the global GDP has almost halved. Its economy remains heavily dependent on oil and gas revenues. Whilst the western world is moving away from fossil fuels, Russia is doubling down on oil and gas. Since 2010, upstream investments in Russia have tripled and as a result the decline of Western Siberian giant oil fields was temporarily halted. This business model, going all in on oil and gas, is not sustainable.

Good contacts are more important than good contracts

Fossil fuel production is among the few industries that can still function reasonably well, from a technical point of view, in a corrupt environment. A different business model, competitive in other industry segments, requires a more open and less corrupt society. For Russia this implies a regime change; something that is too high a price to pay for the Putin administration. It is thus likely to soldier on with its primarily fossil fuel-based business model, implying a slow but steady economic decline.

Jilles van den Beukel and Lucia van Geuns are Energy Specialist and Strategic Advisor Energy at The Hague Centre for Strategic Studies

This article is a short synopsis of the study, recently published on the Russian oil and gas industry: Russia’s unsustainable business model: going all in on oil and gas.